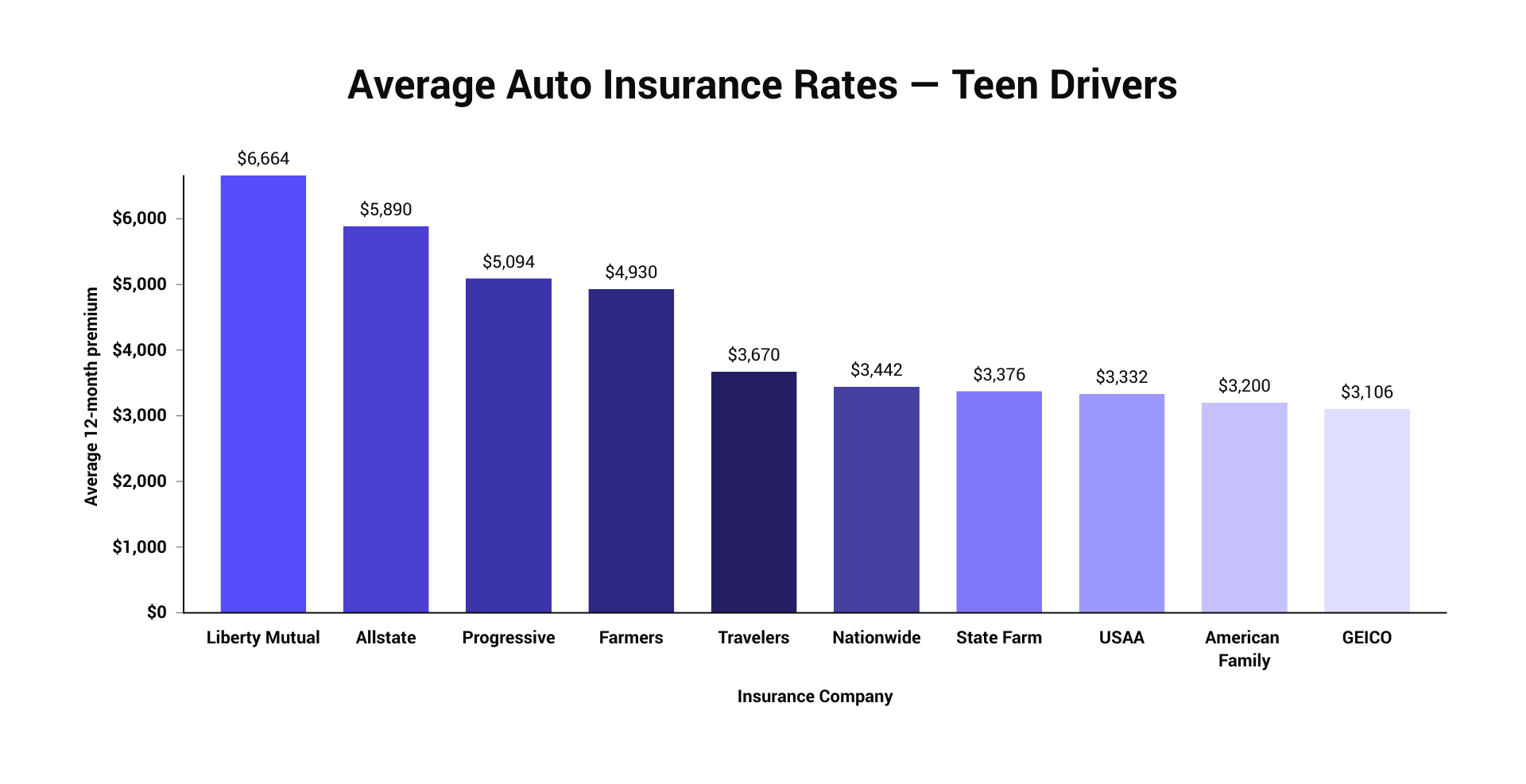

In Addition, State Farm uses many price cuts that can mitigate the expense of including a teenager driver, such as the good trainee discount and also Avoid program. If you're looking for price, GEICO is one of the most effective alternatives available. Their premiums are consistently second-rate, and they have remedies for chauffeurs with poor credit history and also a background of mishaps.

The primary allure of Progressive is that interacting with them is so easy - cheapest auto insurance. Their site is exceptionally instinctive, and its customer care representatives are significantly receptive. Their prices have to do with the very same as State Farm, and they master more unusual kinds of insurance, like bike insurance policy. Allstate works as a one-stop buy the majority of your insurance needs, with vehicle insurance coverage being simply among numerous services they offer.

credit score cars suvs vans

credit score cars suvs vans

USAA insurance policy is constantly among the very best in regards to price and also insurance coverage, despite chauffeurs who have poor debt, are teenagers, or have a background of at-fault crashes. The only drawback is that USAA insurance is just offered to army members, veterans, and their family members. With these aspects and firms in mind, you'll be much better outfitted to discover the very best auto insurance for your needs.

Begin your search and also discover the most effective automobile insurance policy by getting quotes today! This material is produced and maintained by a third celebration, as well as imported onto this web page to aid individuals offer their email addresses. You may be able to find even more info about this as well as comparable web content at (insurance).

Auto insurance policy prices and also are projected to, most likely affected by increasing inflation prices over the past year. Driving & death trends, Resources: National Security Council & the Institute for Traffic Safety And Security Monitoring as well as Study, In the spring of 2021, Americans drove 32% even more miles than during the very same duration in the previous year.

4 Simple Techniques For Car Insurance Rises For The First Time In 18 Months As Drivers ...

Evaluation Add-on Riders as the Part of the Finest Car Insurance Coverage in India: It is always suggested to pay appropriate interest to all the add-on cyclists so that you can select the leading car insurance coverage policy in India with fringe benefits. For your comfort, we have actually detailed below a few crucial electric motor Insurance policy riders.

The comments coming directly from your close to and also dear ones may give you much better insights concerning exactly how its customer assistance as well as claim treatment work. It will help you to make an informed choice. Options for a Flexible Cars And Truck Insurance Coverage: While purchasing the top car insurance coverage policy in India, a versatile insurance coverage is always considerable (car).

Don't fall for them; they might be just a catch. You can encounter a suitable offer online when you take a while out of your busy schedule as well as search throughout the Web - cheap. While comparing automobile insurance plan online, keep the adhering to points in your mind: Compare numerous insurance coverage used by the different insurance coverage carriers.

Some care such as industrial vehicles and SUVs, i. e. Sports Utility Lorry, commonly call for higher costs as insurance coverage companies get a lot of claims on these cars. Normally, diesel automobiles have a 10-15% greater costs than petrol lorries. Dangers Associated With the Place This is based on the registration location.

If theft or loss of the lorry is higher in the area where you reside, then the car insurance premiums increase. Dangers Connected To Motorist of the Automobile The profession and also age of the chauffeur are taken into account. In the situation of multiple motorists of the vehicle, you need to pay higher premiums.

The Buzz on Unitedhealthcare: Health Insurance Plans For Individuals ...

This is the price cut that is deducted from your insurance coverage costs throughout policy renewal. As an option, you can go for NCB (low-cost auto insurance). Take a look at the Insurance Claim Negotiation Proportion (CSR) Before you finalize a car insurance firm, last yet not the least, think about the insurance provider's previous document of case negotiation. Insurance Claim Negotiation Proportion is the time taken by an insurance provider to calm down the cases from its clients.

With that said, below are a few tips that will certainly assist you pick the leading auto insurance coverage firm in India. Take a look: Prior to you select the leading auto insurer, you require to examine your vehicle insurance needs. You need to understand the degree of coverage you are trying to find in addition to any kind of details attachments that you wish to buy.

You should also be conscious of the maximum costs that you can manage to pay for the plan. Since you recognize your vehicle insurance policy needs, you need to locate genuine motor insurance business out there. You can check the credibility of a car insurer by examining its IRDA Registration Number.

The CSR describes the complete portion of cases worked out by the insurance provider. On the various other hand, ICR describes the total percent of premium used by the insurance business against the complete amount of costs collected. You should search for a firm with a higher CSR and ICR as it illustrates a lesser chance of your cases obtaining declined by the insurance firm.

You should go for a firm with a faster claim settlement speed as it stands for that the insurance provider will certainly pay you the claim amount immediately. Next off, you must learn about the network of cashless garages available with the vehicle insurance coverage firm. prices. Cashless garages are the approved garages of the insurance provider where you can get your car repaired on a cashless basis.

Admiral: Car, Multicar And Multicover Insurance Quotes Fundamentals Explained

The customer support of the cars and truck insurance provider need to likewise be identified while picking the most effective electric motor insurance firm. The client service allows you to get a suggestion concerning how conveniently will you be able to contact the insurance provider and also look for aid. You have to pick a firm that offers night and day solutions to its consumers as you can call them 24x7.

If you compare car insurance coverage plan by different motor insurance providers online, you will be able to analyse their protection level, costs price in addition to the advantages supplied. The perfect insurance provider will certainly provide you with optimum protection without making you pay an incredibly high costs rate. It is always much better to examine the consumer reviews of various electric motor insurer prior to choosing any one of them (cheapest auto insurance).

You can pick from any of the prior automobile insurance provider as well as select the most effective motor insurance coverage in India that supplies you optimal protection advantages at a small premium. Cars And Truck Insurer FAQs The most effective cars and truck insurer might not coincide for everybody. Every cars and truck proprietor has specific needs and the insurance company that meets his requirements efficiently will be the leading automobile insurance policy firm for him.

You will be incapable to utilize it till the following revival (cheapest car insurance). Partial insurance claim negotiation refers to the circumstance Visit the website where an electric motor insurance provider pays a part of the insurance claim total up to the policyholder because the repair work price is reduced than the overall IDV or case amount for the automobile.

In situation your cars and truck insurance coverage policy has actually expired, you will be supplied with a moratorium by your electric motor insurance firm to renew your policy. If you do not renew your policy even within the elegance period, you will have to buy a new automobile insurance coverage and will also lose out on your NCB.

The Basic Principles Of The Best Insurers May Be The Ones You've Never Heard Of

cheap insurance affordable car insurance cheap car insurance insurance

cheap insurance affordable car insurance cheap car insurance insurance

In every state, you have numerous auto insurer to pick from-- and also absolutely nothing pays off greater than contrast shopping. auto insurance. has developed partnerships with a range of automobile insurance service providers covering drivers of all kinds, from preferred to risky. To make picking a vehicle insurance policy business stress-free, we did the hefty training for you and developed an useful device that consists of the most effective auto insurance companies in the sector.

Whether you're purchasing new coverage or just intend to switch auto insurance provider, we've got you covered. Locate Firms That Can Help You - credit score.

Material presented is believed to be from reputable sources and no representations are made by our firm as to another parties' educational accuracy or efficiency. All info or suggestions given need to be reviewed in detail with an advisor, accountant or lawful advice prior to execution.

Unless or else indicated, using 3rd party trademarks herein does not indicate or indicate any type of connection, sponsorship, or recommendation in between Great Economic Cents and the proprietors of those hallmarks. Any kind of referral in this web site to 3rd party hallmarks is to recognize the equivalent 3rd party goods and/or solutions. insurance affordable.

With a lot of auto insurer advertising on TV, you're most likely questioning: which automobile insurance provider is just the very best? While it's hard to say one cars and truck insurance provider overtakes all the others, I can guide you in the direction of one that may be best for you. Below is a checklist of a few of our the ideal cars and truck insurance coverage carriers, whom they're best for, and also some of their coolest functions.

The Ultimate Guide To Best Car Insurance Companies In India - Insurancedekho

Neat feature Link your insurance provider for very easy quotes. Licensed in all 50 states, Gabi functions with even more than 40 different insurance coverage suppliers. As a result, clients save an average of $961 yearly on insurance premiums by using this service.

If not, you can authorize off with the peace of mind of knowing you're obtaining an excellent price. You can search a checklist of all the quotes, displayed both as regular monthly and also yearly cost (affordable car insurance).

Just select the one you want as well as get the policy straight through Gabi. Read MU30's full testimonial or discover even more regarding Gabi here. Best for Discounts. Neat function Claim Complete satisfaction Warranty. It's in the name: Allstate does it all. There's rarely an insurance coverage kind, discount, or perk that they do not provide - vehicle.

Check out MU30's full review or learn even more about Allstate below. Best for Eco-friendly automobiles. Neat attribute Better Cars and truck Substitute. Like Allstate, Freedom Mutual is a "big box shop" of insurance policy suppliers. Being the sixth-largest in the nation, Liberty Mutual uses basically every type of insurance policy you can request, with price cuts out the wazoo.

Not known Facts About The Best Car Insurance Companies For 2022 - Moneygeek

But once you carve away at them by becoming part of an alumni organization, being a safe vehicle driver, guaranteeing several cars and trucks, and so on they become much more affordable. Freedom Mutual even uses a discount rate for driving a crossbreed or electrical lorry. liability. That seems like a very apparent discount an insurance coverage service provider would use, yet it isn't.

Customer support ratings. Price cuts. cars. I additionally dug a layer deeper to identify advertising fluff from fact. Normally, it went to this factor that many contenders slid off the listing, either because of a higher-than-average regularity of complaints or frugality when it concerned payments. What remained are firms I would directly rely on with my business.

cheapest low cost risks credit score

cheapest low cost risks credit score

"The entire thing regarding insurance coverage is not always to have the most affordable premiums, however to have the insurance coverage you require if something fails and also these business all stand out in that respect." Technically, USAA had the highest rating in each and every single area of the country, according to J.D. Power's most recent research study on auto insurance (insurance).

cheapest car insurance cheap insurance trucks car insured

cheapest car insurance cheap insurance trucks car insured

And that mosts likely to the very heart of the disadvantage with USAA. You need to be a veteran, presently offering in the united state army or connected with the armed force via straight household connections to be qualified for solutions USAA supplies. That might remove USAA from consideration for a great deal of individuals.